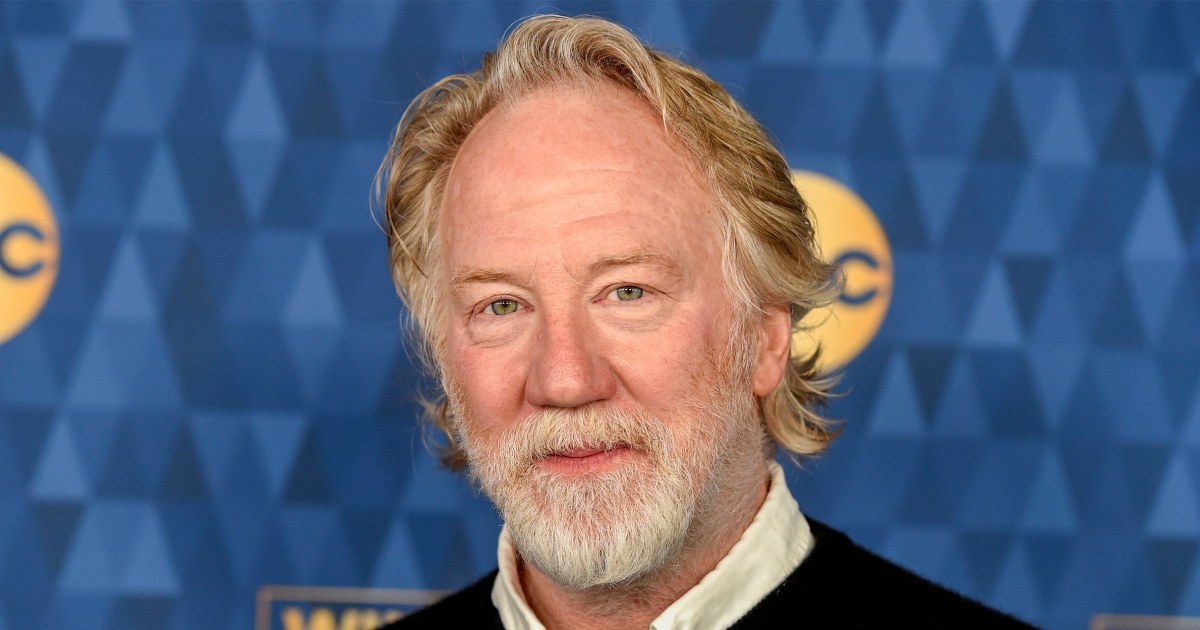

Photo Credit: Robert Kyncl, WMG CEO

Warner Music Group (WMG) has officially reworked the pay package of CEO Robert Kyncl, who was reportedly bagging nearly $19 million per year pre-adjustments.

WMG confirmed the retooled compensation framework in a regulatory filing today, weeks after revealing its financials for the fiscal fourth quarter (July, August, and September 2025). As of the prior fiscal year, Kyncl was pulling down a healthy $18.63 million, according to estimates tallied by the AFL-CIO.

During that period, Kyncl benefited from stock awards totaling $13.52 million, the same source shows. (Incidentally, Kyncl’s overall payday was 257 times larger than the median WMG employee salary, per the AFL-CIO once again. And while that’s a sizable multiple indeed, it’s nowhere near the biggest the industry’s seen.)

Now, however, the pay structure is changing. According to the disclosure, Kyncl was originally set to receive a once-off $10 million stock option. But the amendment, complete with a November 24th grant date and a seven-year term, has split the sum into three equally sized tranches.

These tranches will vest on the same grant date during each of the next three years – becoming exercisable only if Warner Music stock hits certain share-price marks.

Regarding the marks, across fiscal 2026, ’27, and ’28, WMG’s closing value must “exceed the level that would result in a total shareholder return of 8%, 10%, and 12%, respectively, from the grant date.” Additionally, said value needs to hold steady for “at least 20 consecutive trading days within three years” post-grant, per the announcement.

The motivation behind the adjustments isn’t too hard to work out. Though Warner Music has achieved revenue growth (and experienced far-reaching organizational changes) under Kyncl, its share price is down almost 10% from 2025’s beginning.

And the stock’s value when the market closed today, $28.22 per share, also represents a 12.3% decline from the same point in 2024 as well as a 4.6% dip from late 2020.

Elsewhere in the compensation recalibration, Kyncl is poised to score “an annual grant of performance share units,” the first arriving next month, with a target value of $5 million apiece.

Each of those awards “will vest on the third anniversary of the grant date subject to Mr. Kyncl’s continued employment” – with the precise number of earned shares dependent “on the achievement of financial and long-term goals to be established by” WMG.

Finally, the last of the pay pivots describes Kyncl’s cash severance. If the exec’s terminated without cause or exits for “good reason,” the payment will equal “his total annual target cash and equity compensation,” his estimated out-of-pocket health-plan coverage for the coming 12 months, and “a pro rata annual bonus for the year of termination.”