Markets didn’t just get faster; they got busier. One screen won’t save you anymore. This piece breaks down what a full risk stack looks like on MT4/MT5/cTrader, why time is now your scarcest resource, and how teams turn many small signals into a few right actions—with proof.

If you run a brokerage today, you rarely fight one big fire. You juggle many small ones at once: a quote stream goes a little stale, a copy group wakes up, a swap change is late, margin calls spike after a macro print. None of this is exotic. The problem is time. You don’t get ten minutes to decide; some days you don’t get ten seconds.

The desks that stay calm don’t rely on point tools. They work with a risk stack—a few layers that see, decide, and act together. Fewer tabs. Fewer emails. Fewer “what just happened?” moments.

The job changed: not just faster—busier

-

24/5 meets 24/7. FX still runs five days, but crypto and synthetic products keep risk alive on weekends.

-

Event pile-ups. CPI/NFP and rate decisions now collide with dividends, swaps, and rollovers. Treat them as “edge cases,” and every week becomes an edge case.

-

More automation on the client side. Copy trading and group signals mean flow can switch on instantly, across many accounts.

-

Outage and geo-friction risk. Regional blocks and connectivity incidents don’t wait for quiet hours.

A quick look back (why time is the real risk)

Ten years ago, “one main dashboard + a solid bridge” could carry a retail broker. Today that creates lag debt—little gaps between seeing, deciding, and acting. It seems harmless until a Friday print hits, quotes desync for 90 seconds, and a cohort rides the gap. By Monday you’re doing forensics instead of planning growth.

What a full risk stack actually includes (five layers, plain English)

1. Unified visibility

One place to see the session right now: dealing exposure, A/B books, quotes health, live alerts, across all servers. No swivel-chair ops.

2. Signals that matter

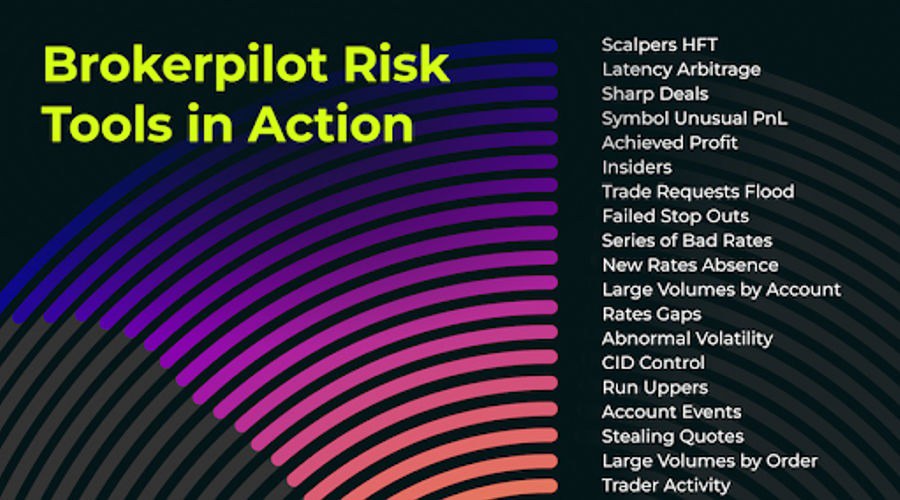

Not vanity charts—actionable triggers. Typical set: Latency Arbitrage, Scalpers/HFT, Copy Cohorts (rings), Insiders, Churning, Rates Gaps/Desync, New Rates Absence, Large Volumes (order/account), Stop-out Abusers, Abnormal Volatility, Symbol-level unusual P&L, and so on.

From our implementations across dozens of brokers, we usually see a few dozen active signals in production at any time; the top five drive most automated actions.

3. Automatic guardrails

Rules tied to signals: route A/B/Hybrid, hedge on accept, tighten leverage by equity tier, quarantine a symbol or group, and run corporate-action jobs (dividends, swaps, rollovers) with prepare → approve → log. Software handles the obvious moves; people look at exceptions.

4. Operations that don’t crack on busy days

A simple calendar so dividends/swaps/rollovers are boring and repeatable—exactly how you want them.

5. Evidence on tap

Clean post-trade reports: quote snapshots, order path (received → last look/accept → fill/reject), which trigger fired, what action ran, and timings. Five minutes to explain an outcome beats five emails.

Bonus: a quotes/ticks store (even feedable to a TradingView widget) helps show what the market looked like at decision time.

What goes wrong without a stack (three familiar stories)

1. The silent desync

Pricing looks fine on screen, but one LP drifts. A small cluster wins on stale quotes. With no automatic hedge, no cohort tag, and no event mode, P&L slips away in minutes; support spends hours explaining slippage.

2. The corporate-action stumble

A swap or dividend update is missed during a chaotic week. Each ticket is small—until there are many. A two-minute calendar job would have avoided the unwind.

3. The “speed is crime” mistake

In fear of toxic flow, you punish all fast traders. Short-term P&L improves; brand and volumes don’t. A better setup separates latency arbitrage from legitimate scalping and treats them differently.

Three drills you can steal this week

1) Macro-print drill (CPI/NFP)

-

−10 min: event mode ON → tighten leverage for low-equity tiers; widen LA thresholds on gold/indices.

-

During: suspected cohorts route conservatively; deep symbols hedge on accept (aim to send the hedge within ~100–150 ms—tune by symbol).

-

+30 min: event mode OFF; thresholds normalize; an after-action report compiles itself.

2) Outage/geo-block drill

Quotes health goes yellow; logins drop from one region. An alert pins it, a comms template goes out, temporary symbol limits apply, and hedge fails over to a backup LP. The report lands in the channel with timestamps and actions.

3) Ops reliability drill

Weekly 15-minute review of dividends/swaps/rollovers: who prepared, who approved, what ran, any diffs. Boring by design. Boring saves reputations.

What to measure (so you know it’s working)

-

Time to detect (TTD): seconds from issue to alert.

-

Time to action (TTA): milliseconds from accept to hedge/route/limit.

-

False-positive rate: how often rules penalize healthy flow.

-

Ops defect rate: missed/incorrect corporate actions per month.

-

Complaint cycle time: minutes to assemble evidence and close a ticket.

If these trends are the right way, P&L and reputation usually follow.

“Isn’t this just more tooling?”

No—fewer decisions at the right moment. A point tool gives you another tab and another alert. A stack removes obvious decisions by encoding them as rules. Dealers get their evening back; risk leads spend Monday on strategy, not archaeology.

A short, anonymized example

A mid-size broker running multiple servers moved from point tools to a stack approach. No buzzwords—just three changes:

1. symbol-specific LA thresholds on XAUUSD and US100,

2. equity-tier leverage around macro prints,

3. a short quarantine for two recurring copy cohorts.

Two weeks later: meaningfully lower exposure to toxic patterns and fewer “why did I get this fill?” threads. Same team. Fewer fires. Results vary; the method is repeatable.

Practical next steps (pick one)

-

Run an event-mode drill this Friday. Tighten leverage for low-equity tiers ten minutes before the print; relax thirty minutes after. Measure TTD/TTA.

-

Make a one-page “signal → action → SLA.” Four rows: Latency Arbitrage, Copy Cohorts, Rates Gaps/Desync, Large Volumes. Agree on who owns each action.

-

Put corporate actions on a calendar. Dividends, swaps, rollovers with prepare → approve → log. Small habit, big risk removed.

Further reading:

Markets didn’t just get faster; they got busier. One screen won’t save you anymore. This piece breaks down what a full risk stack looks like on MT4/MT5/cTrader, why time is now your scarcest resource, and how teams turn many small signals into a few right actions—with proof.

If you run a brokerage today, you rarely fight one big fire. You juggle many small ones at once: a quote stream goes a little stale, a copy group wakes up, a swap change is late, margin calls spike after a macro print. None of this is exotic. The problem is time. You don’t get ten minutes to decide; some days you don’t get ten seconds.

The desks that stay calm don’t rely on point tools. They work with a risk stack—a few layers that see, decide, and act together. Fewer tabs. Fewer emails. Fewer “what just happened?” moments.

The job changed: not just faster—busier

-

24/5 meets 24/7. FX still runs five days, but crypto and synthetic products keep risk alive on weekends.

-

Event pile-ups. CPI/NFP and rate decisions now collide with dividends, swaps, and rollovers. Treat them as “edge cases,” and every week becomes an edge case.

-

More automation on the client side. Copy trading and group signals mean flow can switch on instantly, across many accounts.

-

Outage and geo-friction risk. Regional blocks and connectivity incidents don’t wait for quiet hours.

A quick look back (why time is the real risk)

Ten years ago, “one main dashboard + a solid bridge” could carry a retail broker. Today that creates lag debt—little gaps between seeing, deciding, and acting. It seems harmless until a Friday print hits, quotes desync for 90 seconds, and a cohort rides the gap. By Monday you’re doing forensics instead of planning growth.

What a full risk stack actually includes (five layers, plain English)

1. Unified visibility

One place to see the session right now: dealing exposure, A/B books, quotes health, live alerts, across all servers. No swivel-chair ops.

2. Signals that matter

Not vanity charts—actionable triggers. Typical set: Latency Arbitrage, Scalpers/HFT, Copy Cohorts (rings), Insiders, Churning, Rates Gaps/Desync, New Rates Absence, Large Volumes (order/account), Stop-out Abusers, Abnormal Volatility, Symbol-level unusual P&L, and so on.

From our implementations across dozens of brokers, we usually see a few dozen active signals in production at any time; the top five drive most automated actions.

3. Automatic guardrails

Rules tied to signals: route A/B/Hybrid, hedge on accept, tighten leverage by equity tier, quarantine a symbol or group, and run corporate-action jobs (dividends, swaps, rollovers) with prepare → approve → log. Software handles the obvious moves; people look at exceptions.

4. Operations that don’t crack on busy days

A simple calendar so dividends/swaps/rollovers are boring and repeatable—exactly how you want them.

5. Evidence on tap

Clean post-trade reports: quote snapshots, order path (received → last look/accept → fill/reject), which trigger fired, what action ran, and timings. Five minutes to explain an outcome beats five emails.

Bonus: a quotes/ticks store (even feedable to a TradingView widget) helps show what the market looked like at decision time.

What goes wrong without a stack (three familiar stories)

1. The silent desync

Pricing looks fine on screen, but one LP drifts. A small cluster wins on stale quotes. With no automatic hedge, no cohort tag, and no event mode, P&L slips away in minutes; support spends hours explaining slippage.

2. The corporate-action stumble

A swap or dividend update is missed during a chaotic week. Each ticket is small—until there are many. A two-minute calendar job would have avoided the unwind.

3. The “speed is crime” mistake

In fear of toxic flow, you punish all fast traders. Short-term P&L improves; brand and volumes don’t. A better setup separates latency arbitrage from legitimate scalping and treats them differently.

Three drills you can steal this week

1) Macro-print drill (CPI/NFP)

-

−10 min: event mode ON → tighten leverage for low-equity tiers; widen LA thresholds on gold/indices.

-

During: suspected cohorts route conservatively; deep symbols hedge on accept (aim to send the hedge within ~100–150 ms—tune by symbol).

-

+30 min: event mode OFF; thresholds normalize; an after-action report compiles itself.

2) Outage/geo-block drill

Quotes health goes yellow; logins drop from one region. An alert pins it, a comms template goes out, temporary symbol limits apply, and hedge fails over to a backup LP. The report lands in the channel with timestamps and actions.

3) Ops reliability drill

Weekly 15-minute review of dividends/swaps/rollovers: who prepared, who approved, what ran, any diffs. Boring by design. Boring saves reputations.

What to measure (so you know it’s working)

-

Time to detect (TTD): seconds from issue to alert.

-

Time to action (TTA): milliseconds from accept to hedge/route/limit.

-

False-positive rate: how often rules penalize healthy flow.

-

Ops defect rate: missed/incorrect corporate actions per month.

-

Complaint cycle time: minutes to assemble evidence and close a ticket.

If these trends are the right way, P&L and reputation usually follow.

“Isn’t this just more tooling?”

No—fewer decisions at the right moment. A point tool gives you another tab and another alert. A stack removes obvious decisions by encoding them as rules. Dealers get their evening back; risk leads spend Monday on strategy, not archaeology.

A short, anonymized example

A mid-size broker running multiple servers moved from point tools to a stack approach. No buzzwords—just three changes:

1. symbol-specific LA thresholds on XAUUSD and US100,

2. equity-tier leverage around macro prints,

3. a short quarantine for two recurring copy cohorts.

Two weeks later: meaningfully lower exposure to toxic patterns and fewer “why did I get this fill?” threads. Same team. Fewer fires. Results vary; the method is repeatable.

Practical next steps (pick one)

-

Run an event-mode drill this Friday. Tighten leverage for low-equity tiers ten minutes before the print; relax thirty minutes after. Measure TTD/TTA.

-

Make a one-page “signal → action → SLA.” Four rows: Latency Arbitrage, Copy Cohorts, Rates Gaps/Desync, Large Volumes. Agree on who owns each action.

-

Put corporate actions on a calendar. Dividends, swaps, rollovers with prepare → approve → log. Small habit, big risk removed.

Further reading: