Making the business case for solar-plus-storage

Written by admin on April 3, 2023

Much has been said about the benefits installing solar and batteries can offer to businesses but, as companies face mounting input cost inflation, is the upfront investment too much to bear or have volatile electricity costs made the decision a no-brainer?

Paul Conlon

The rising cost of energy prices is a significant concern for businesses across the globe. Fluctuations in energy costs can have a significant impact on a company’s bottom line, making it challenging to budget effectively and maintain a competitive edge. Fortunately, advancements in battery energy storage and solar are providing a solution to help hedge against energy price risks.

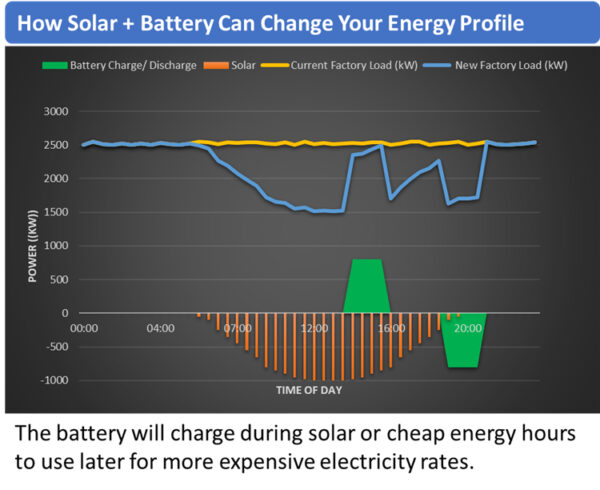

Actual savings and revenues will depend on various factors such as the location, size, and type of installation; energy prices; and demand profiles in a specific region. The interaction of all these variables on any given day ensures the decision making process can become quite complex. Under such circumstances, it is useful to employ mathematical optimization programming to achieve the best outcome and derive the greatest return on investment. The critical point to note is that a battery co-located with solar changes the risk profile of the investment, ensuring that some of the uncertainties associated with weather-based power generation are, at least in part, mitigated.

Battery storage and solar systems offer businesses an innovative solution to hedge against energy price risks. By generating their own electricity, reducing their reliance on the grid, and storing excess energy, businesses can significantly reduce energy costs and improve their energy efficiency. Moreover, investing in these technologies can help businesses increase their energy independence, reduce their carbon footprint, and contribute to a more sustainable future.

With these benefits in mind, it is clear battery storage and solar are an essential investment for businesses looking to hedge against energy price risks and remain competitive in an ever-changing market.

About the author: Paul Conlon is head of modelling & forecasting at Dublin-based artificial-intelligence-backed energy services company GridBeyond and is a regular speaker at industry conferences, on energy price forecasting and risk management. Paul has more than 20 years’ experience in the energy and tech sectors and is an expert in numerous analytical techniques applied to gas and power markets. He has worked in a variety of roles within energy and consulting organizations covering market design, regulation, and trading.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.