What the Data Tells Us About Japan’s Next Chapter in Hospitality

Written by admin on January 21, 2026

Japan’s accommodation industry is thriving in 2025: strong business results, rising investments, and ambitious workforce plans underline optimism across the sector. From AI adoption to training initiatives, the industry is tackling challenges with innovation and energy – poised for continued growth nationwide.

These are the headline findings of the 2025 Japan Accommodation Barometer, a collaboration between Statista and Booking.com, surveys 260 Japanese hoteliers and accommodation managers. It offers insights into the sector’s economic development, industry sentiment, and investment plans related to digital transformation and the hospitality workforce.

Japan’s accommodation sector has reported stronger past, present, and future business sentiment for the third consecutive year. In 2025, 76% of surveyed accommodations rated their past business performance as good or very good, up from 63% in 2024 and 56% in 2023. Satisfaction with current economic conditions follows a similar upward trend, with 73% of Japanese respondents reporting a (very) good overall economic situation in 2025.

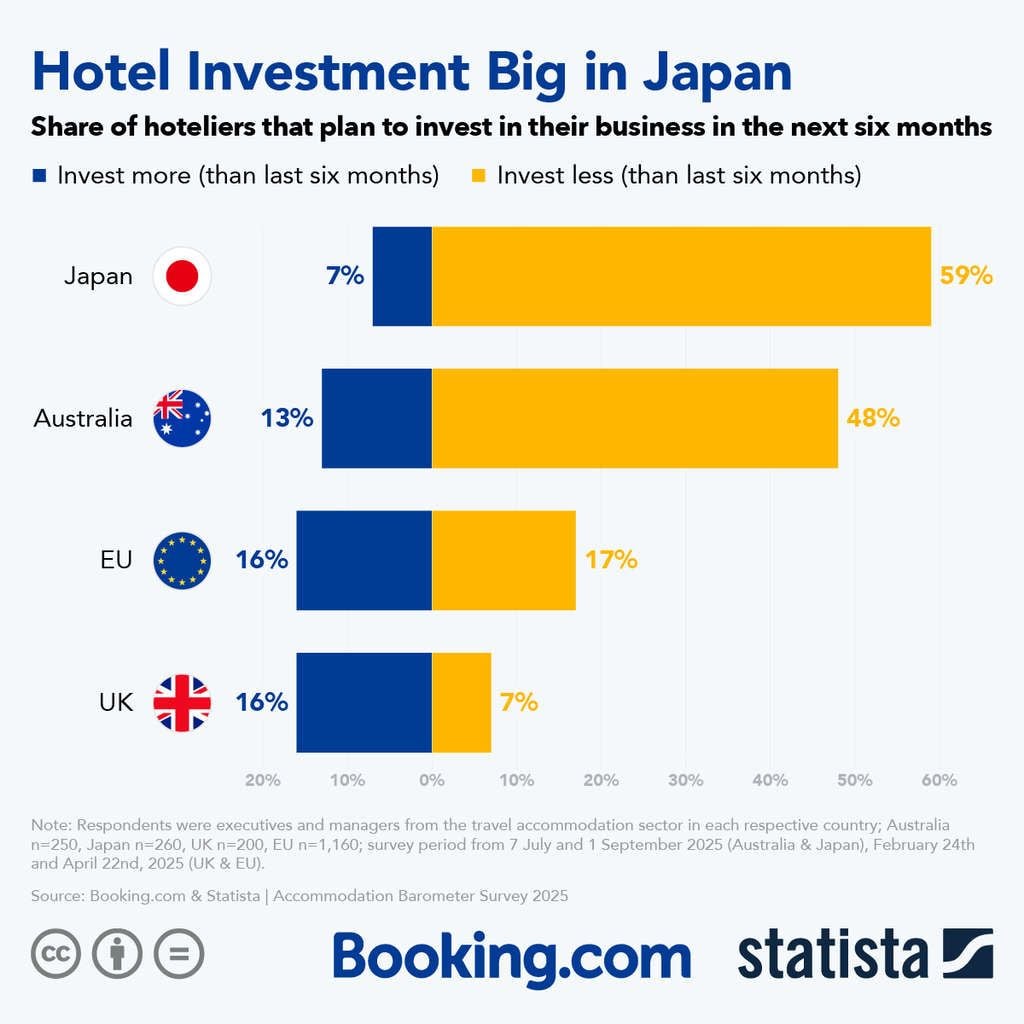

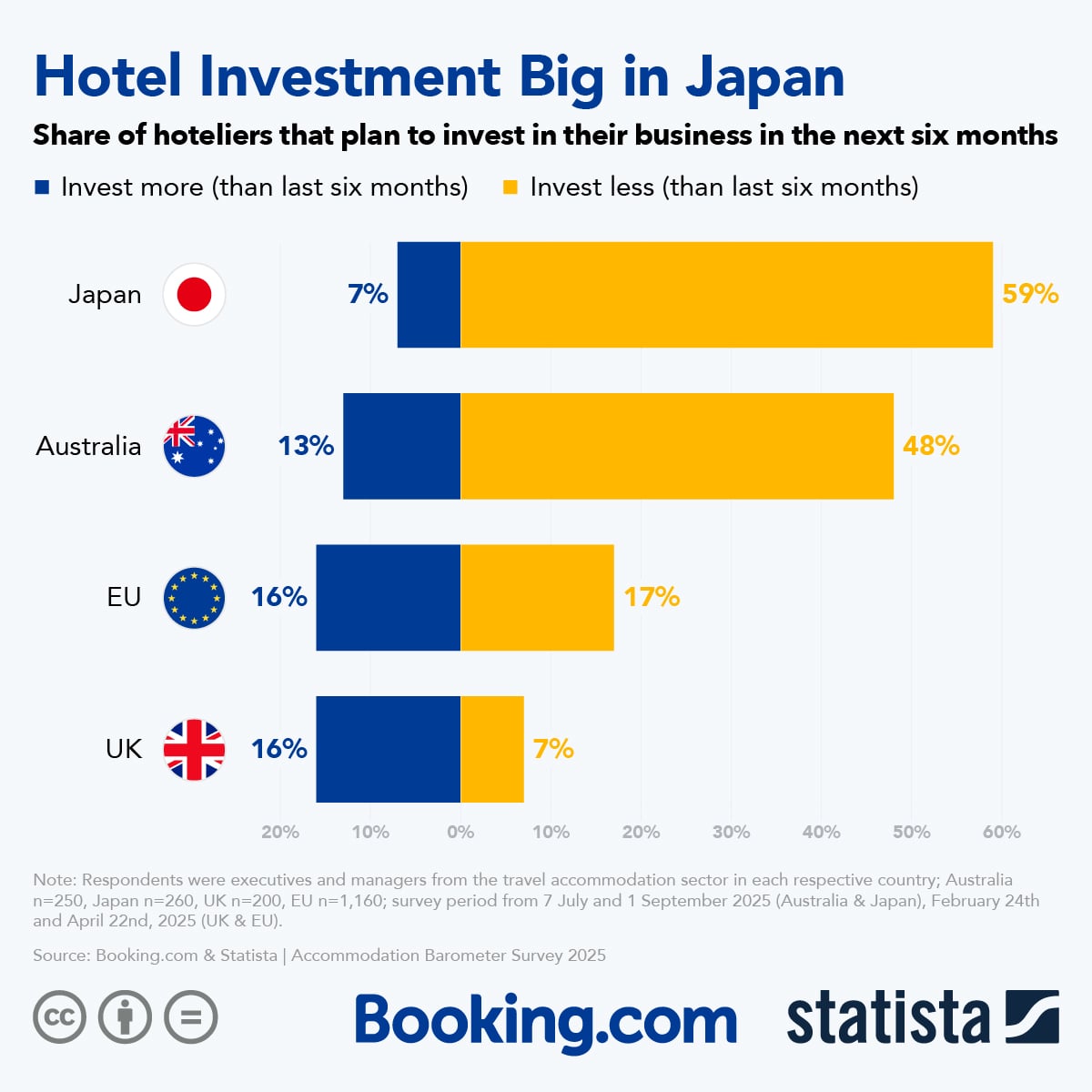

Investment confidence has grown, with now three in five businesses intending to increase spending in the next six months, compared to half in 2024 and a mere quarter in 2023. This coincides with a growing ease in obtaining funds, with now 55% of Japanese accommodations reporting no difficulty, compared to only one in ten who reported challenges.

More than two-thirds of Japanese respondents have also reported increases in occupancy rates and average daily rates, contrasting with plateauing economic indicators in Europe. Bigger accommodations (> 250 beds) have maintained stable sentiment, while smaller properties have seen a notable jump in positivity.

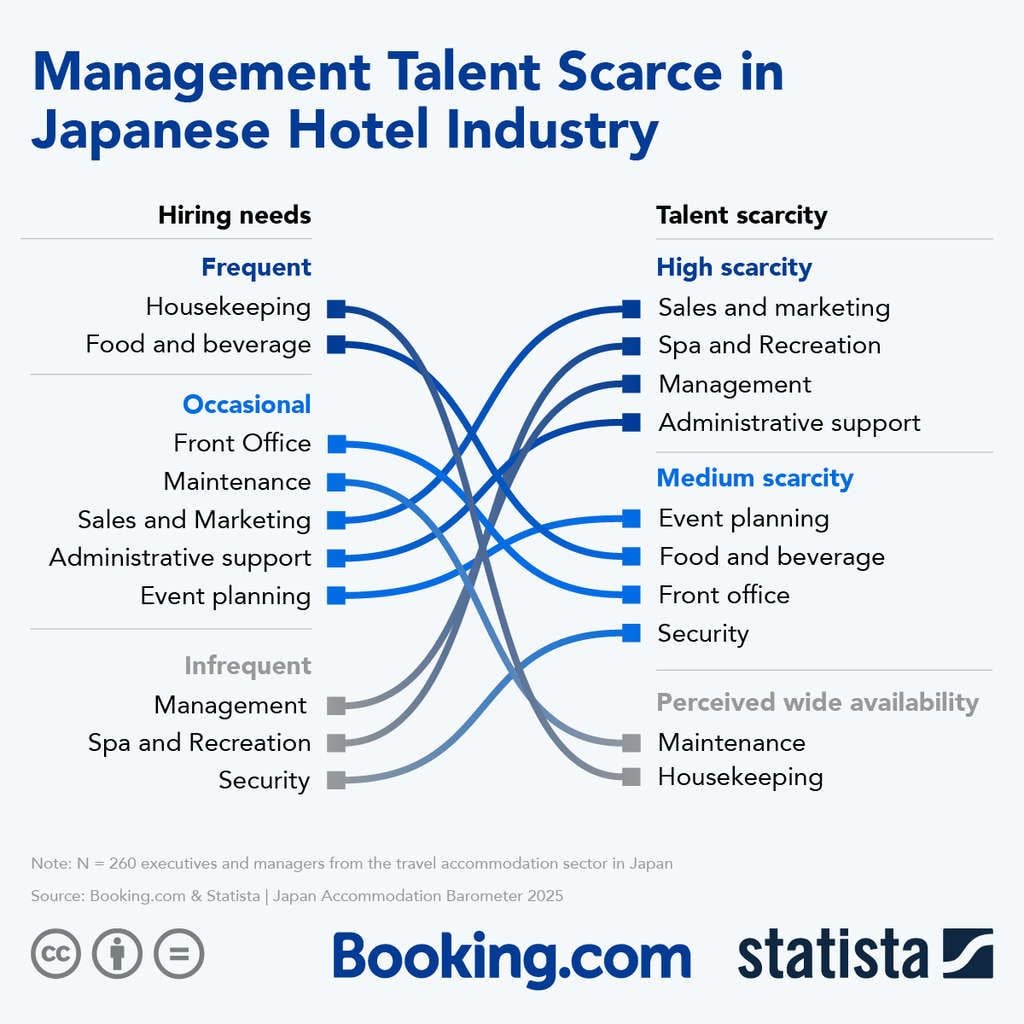

Employment growth plans are strong, with the national average at 7.9 new hires over the next year, which translates to just under one-third of the total workforce. Employees for housekeeping and food and beverage are generally more readily available, while sales and marketing roles are among the hardest positions to fill.

Training and upskilling are widespread, especially through internal and online programs, with 49% planning increased investment in staff development. Hotels and Ryokans regularly use a mix of internal and external training programs, however the former is favored more heavily by Ryokans. High costs and staff turnover are the main barriers to further investment in employee development.

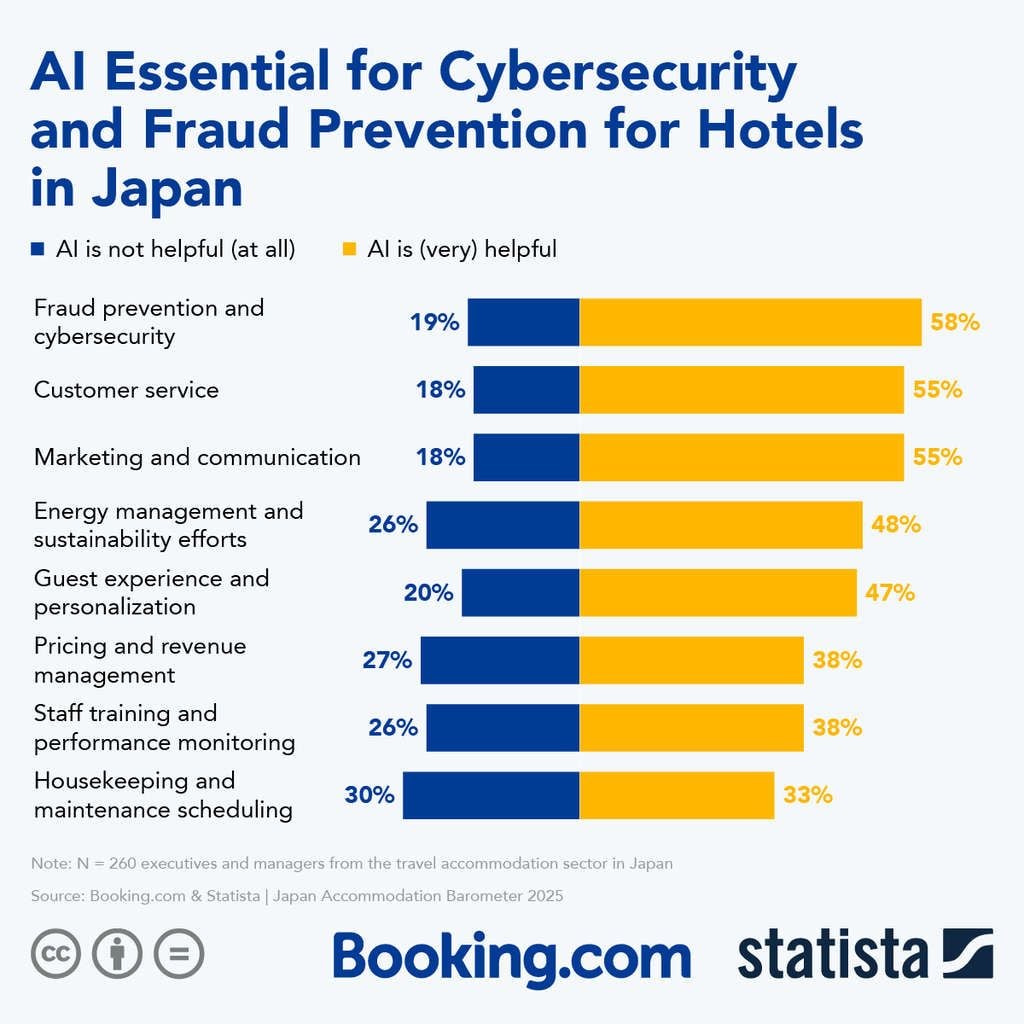

Technology adoption is advancing and any Japanese hoteliers recognise the potential benefits of AI for their business but each use case is not without a sizable subset of hoteliers who do not find it beneficial. The strongest support for AI is in fraud prevention and cybersecurity, with around 6 in 10 hoteliers recognising this area as a (very) helpful use case for AI. But even for the most popular use case, almost 1 in 5 do not find AI useful for fraud prevention.

Similarly, marketing and communication, as well as customer service, are seen as other promising areas and yet around 20% of respondents do not see AI’s value in this instance. For operational tasks – such as housekeeping schedules and staff training – accommodation managers appear more skeptical about the value AI can deliver, however even these processes have attracted.

Different types of accommodations expressed divergent levels of confidence regarding the utility of AI. For example, 71% of Ryokans find AI helpful for customer service, making this use case the most popular among Ryokans, whereas only 45% chain hotels and 50% of short-term rentals share this view. Ryokans were also more likely than other accommodations types to find AI beneficial for fraud prevention or energy management.

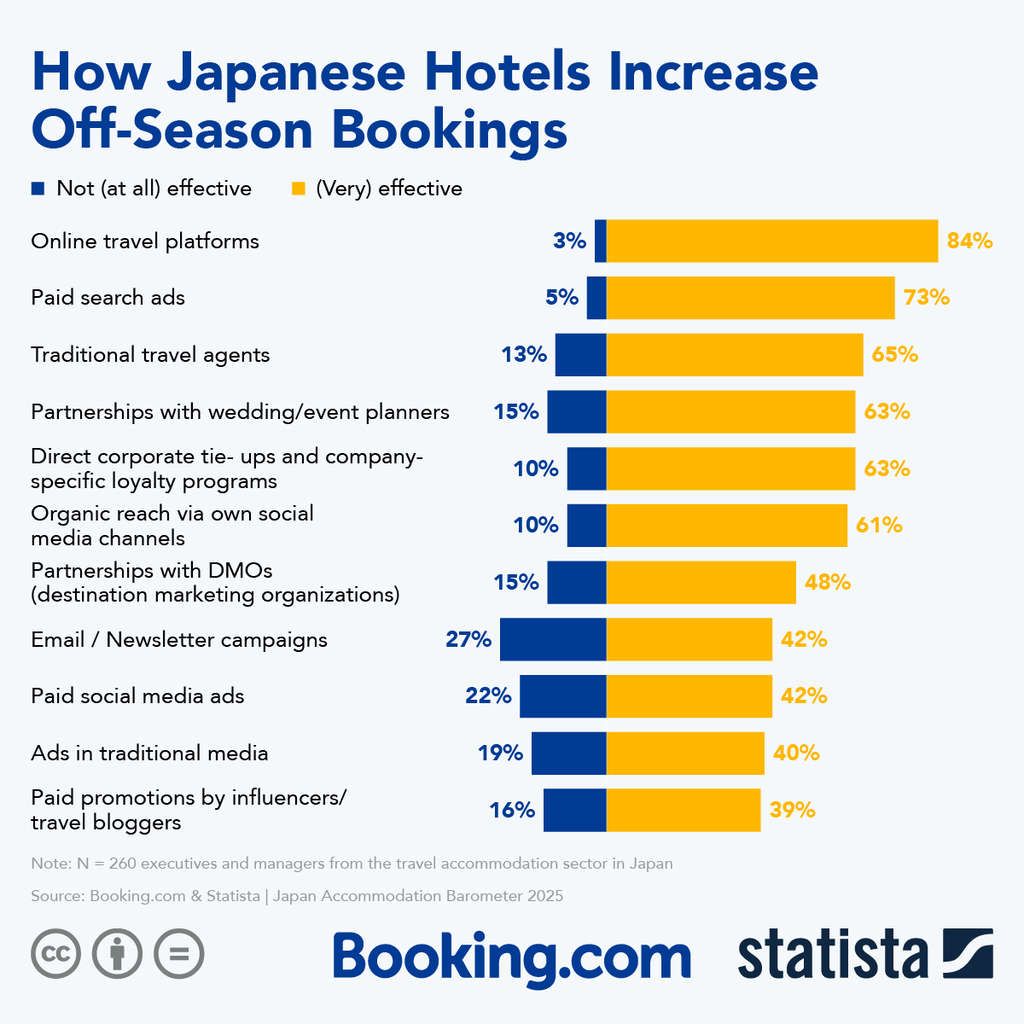

Seasonality strategies focus on leveraging OTAs, paid search ads, and flexible booking policies. Many operators see untapped opportunities in event-based travel through greater engagement with organisers and tourism boards.

When asked about how accommodations boost low season bookings, hoteliers recognised online travel platforms as a valuable element in their marketing toolkit. In fact, 48% said that collaborating with digital travel platforms, including social media and online travel platforms, was a strategy they used to mitigate the effects of seasonality. Alongside digital platforms and social media, flexible booking and cancellations policies in the off-season (38%), modifying staff levels (37%) and offering special rates in the off season (35%) were also key strategies used by Japanese accommodations to secure year-round relevance.

Overall, the Japan Accommodation Barometer 2025 results reflect an accommodation industry with robust growth momentum and a strong investment appetite. This environment is ripe for innovation in tourism with regional variations and workforce challenges shaping strategic priorities for 2025 and beyond.

The Japanese Accommodation Barometer

This third edition of the Japan Accommodation Barometer is based on a survey of 260 executives and managers in the Japanese accommodation sector. It is jointly produced by Booking.com and Statista.

:max_bytes(150000):strip_icc():format(jpeg)/equalizer-5c6d4961c9e77c0001f24ef3.png)