Is Broadcom Stock a Buy for 2026?

Written by admin on January 11, 2026

Key Points

-

Broadcom’s custom AI computing units are becoming a larger part of its business.

-

Wall Street analysts expect monster growth over the next few years.

-

Investors must pay a premium to own Broadcom stock.

- 10 stocks we like better than Broadcom ›

Broadcom (NASDAQ: AVGO) had one of the best years of the big tech stocks. It rose nearly 50% for the year, outperforming Nvidia (NASDAQ: NVDA) by 10 percentage points. That’s an impressive run, but the real question is, can Broadcom keep that momentum up in 2026?

I think Broadcom has a great chance to outperform the market in 2026 and is well worth buying. But why is Broadcom a top stock pick for 2026? Let’s find out.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Custom AI chips are becoming Broadcom’s top product

Broadcom does a lot of business in the tech sector. It provides cybersecurity software, mainframe hardware and software, and virtual desktop software through VMware, a company it acquired a few years back. This business might be at Broadcom’s core, but there is another, more exciting business unit that’s really gaining momentum.

Broadcom is taking a different approach to the artificial intelligence computing hardware game. Instead of designing a broad-purpose graphics processing unit (GPU) as Nvidia did, it’s partnering directly with AI hyperscalers to design custom computing units tailored to their needs. This strategy fills a gap in the offerings available on the market, and they are becoming great alternatives to Nvidia GPUs.

However, they’re not a direct GPU replacement.

Broadcom’s custom AI chips are known as ASICs, application-specific integrated circuits. They are set up to run one speicific kind of workload. Limiting flexibility can be an issue in many scenarios, but if all of these computing units are running a single workload type, then they can shine. Furthermore, because Broadcom and the AI hyperscalers have cut the middleman out, these units are far cheaper. That’s an exciting combination, and there’s a reason why the market is so bullish on Broadcom’s stock.

Right now, Broadcom’s AI semiconductor business makes up a meaningful part of its overall business, but it isn’t the dominant component. That’s expected to change in 2026. In the fourth quarter of its fiscal year 2025 (ending Nov. 2), Broadcom’s AI semiconductor revenue totaled $6.5 billion, up 74% year over year. As a whole, Broadcom’s revenue totaled $18 billion, up 28% year over year. So, AI semiconductor revenue makes up more than a third of its business.

But that balance is starting to shift.

In Q1, Broadcom expects AI semiconductor revenue to total $8.2 billion, up 100% year over year. Overall, it expects $19.1 billion in total revenue. So, in Q1, AI semiconductor revenue will make up nearly half of Broadcom’s total. That number is expected to increase throughout the year as more companies order Broadcom’s custom AI chips and new customers come online.

This is the core of Broadcom’s investing thesis, and it’s incredibly promising. Wall Street analysts project Broadcom’s FY 2026 revenue will grow at a 51% pace, and next year’s revenue to grow at a 36% pace. That’s an incredibly bullish outlook, making Broadcom a top stock to consider for 2026, but is the price right?

Broadcom carries a premium price tag

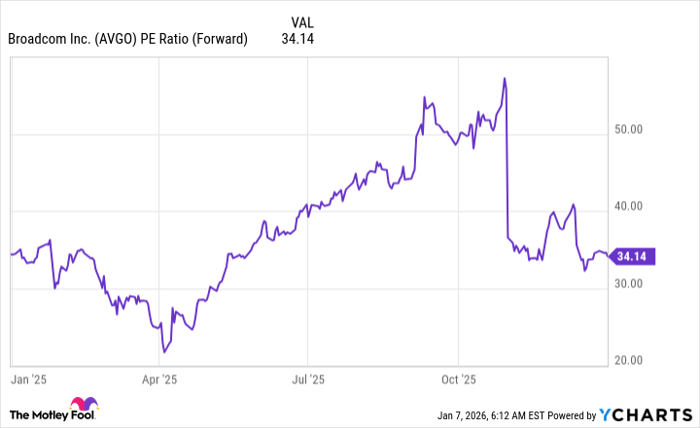

The market is well aware of Broadcom’s promising future. As a result, it has a premium valuation. Broadcom trades for 34 times forward earnings, not a cheap price tag.

AVGO PE Ratio (Forward) data by YCharts

For comparison, Nvidia trades for 25 times FY 2027 earnings (ending January 2027). That’s a sizable premium that you have to pay to own Broadcom, and the investment thesis between these two couldn’t be more different.

An Nvidia investment is a bet that its dominance is going to continue. A Broadcom investment is a bet that it will disrupt the current king of AI computing. It’s a lot harder to dethrone a company than maintain one, so I’d give the edge to Nvidia here.

Broadcom has huge potential, but you have to pay up for that, whereas Nvidia has already achieved it. I’m more bullish on Nvidia than Broadcom, but I think both will do well in 2026 and beyond.

Should you buy stock in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $482,326!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,133,015!*

Now, it’s worth noting Stock Advisor’s total average return is 968% — a market-crushing outperformance compared to 197% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of January 10, 2026.

Keithen Drury has positions in Broadcom and Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.