AI Landscape with Nvidia Dominance

Written by admin on August 19, 2025

Dylan Patel, founder of SemiAnalysis, talks about the AI hardware landscape, GPT-5, business models, and the future of AI infrastructure with A16z Venture partners. Dylan covers Nvidia’s dominance, reactions to OpenAI’s GPT-5, monetization strategies, and threats from custom silicon.

Nvidia has unassailable advantages in AI hardware: superior networking, high-performance memory (HBM), process nodes, time-to-market, ramp-up speed, locked up key (HBM and high end fab)chip supplies from suppliers like TSMC and SK Hynix, and cost efficiency across the supply chain (e.g., racks, copper cables). Patel argues that competitors cannot simply replicate Nvidia’s approach. They must achieve a 5x better leap in performance or efficiency to have a chance.

GPT 5 Disappointing

Patel calls GPT-5 disappointing for advanced users, as it replaces access to superior models like GPT-4.5 or o3. GPT 5 thinks for 45 seconds while a less compute-intensive version only needs 5–10 seconds. The base model improved slightly but it’s not larger than predecessors and uses less compute overall. OpenAI optimized for efficiency byrouting queries via an auto mode to mini models, regular models, or thinking modes based on complexity. This reduces waste but also means less power for power users.

Patel contrasts business models: Anthropic focuses on B2B (API/cloud), while OpenAI’s revenue is mostly consumer subscriptions without effective free-user monetization.

Future Vision of Coordinated Cheap, Powerful Models and Agents

Future will see optimized routers and agents for efficiency and monetization. Low-value queries (“Why is the sky blue?”) go to cheap models and high-value questions and tasks get handled by agents and tool calls (e.g., “Best DUI lawyer near me”). Agents will search, negotiate, and book services and take a cut. Patel predicts agents will integrate with e-commerce.

Patel’s advice to Sam Altman. Launch credit-card integration for agentic actions, taking cuts on bookings. This requires the agents to do work at high level that is trustworthy.

Nvidia stock is up 70%. AI demand must continue growing.

1. Training demand accelerates as XAI, Meta, Google are buying a lot.

2. OpenAI/Anthropic getting 30% of chips via Microsoft/CoreWeave/Oracle.

3. Inference adds take another third

4. uneconomic providers the rest but they will not sustain unless they start making money

Custom Silicon is a Threat to NVIDIA

Custom silicon from concentrated AI players. Google has millions of TPUs and uses them all. Amazon is geting millions of Trainium chips. Meta upping orders massively. Microsoft lags as their chips suck. OpenAI has a silicon team.

If AI disperses with open-source models from China, easy deployment then Nvidia wins. If AI is concentrated then hyperscalers will make their own custom silicon successfully.Google should sell TPUs externally (not just rent) for higher market cap, but requires cultural reorganization. TPU value potentially exceeds Google’s search business.

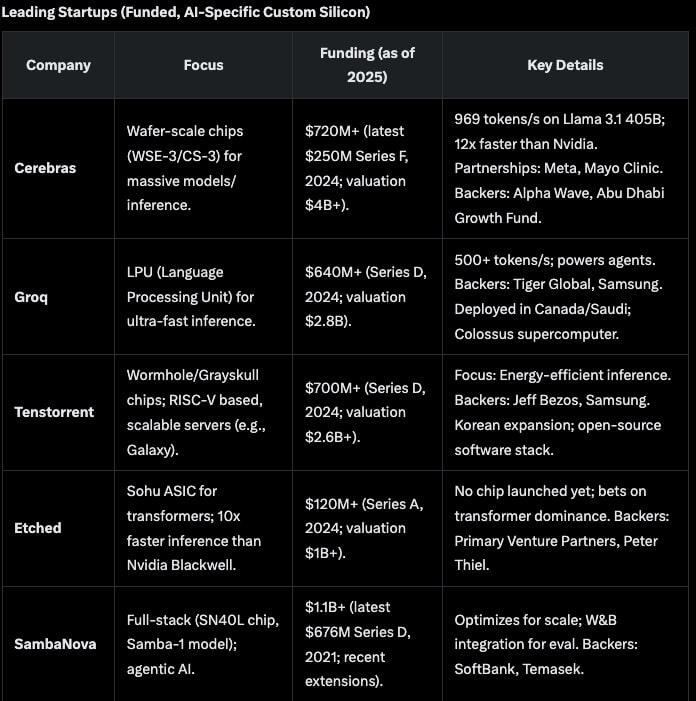

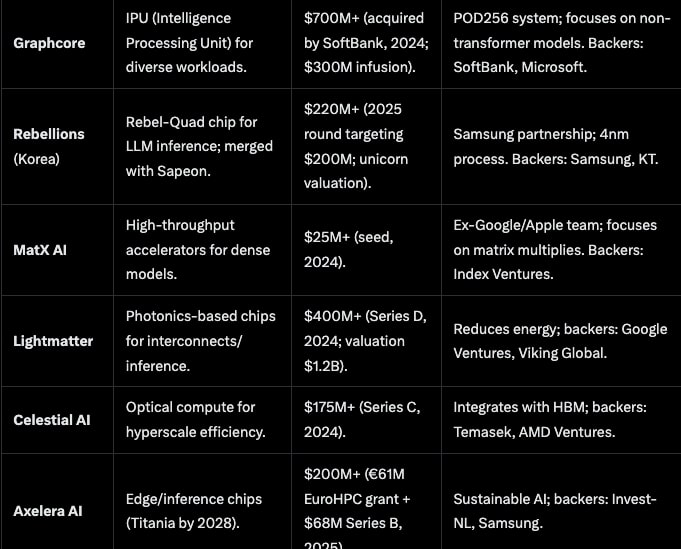

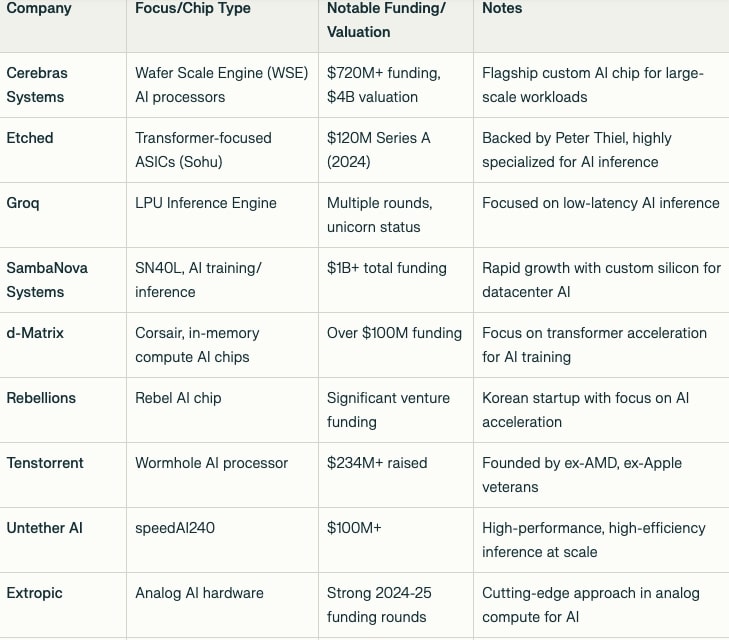

Silicon Startup Boom

Billions flow into silicon startups despite high capital needs. Etched raised hundreds of millions without launching chips. This is unprecedented and indicates AI hype bubble. Other newish accelerators: MatX and ~10 others.

Older but still recent chip companies: Groq, Cerebras, SambaNova, Tenstorrent, Graphcore.

These new chip makers have no captive customers like hyperscalers. They must beat Nvidia by 5x in hardware efficiency for specific workloads so that the advantage remains when they reach the product launch. However, AI models evolve. Early bets failed as model sizes grew and needed more DRAM/SRAM memory.

The Economics of AI: Cost vs. Performance

China: Provinces ban H20 as inefficient; Huawei lags. Virtually unlimited power but prefers cost-effective external rentals. Smuggling/renting bypasses chip restrictions.

Data Centers have Power/cooling problems but are not the immediate bottleneck. the most important issue is building fast enough and getting suitable locations. Tents and mobile power solutions are used to prioritize speed over cost.

Intel could become a TSMC alternative. Intel has to speed up designs for chip from 6 years to 3 years and fix chip yields. Hyperscalers may invest $5 billion each to counter the TSMC monopoly.

Nvidia should invest hundreds of billions in energy infrastruture and technology to drive more AI chip sales.

Microsoft needs a shake up as they are losing to Oracle and CoreWeave.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.